Simplified Payments, For Every Business.

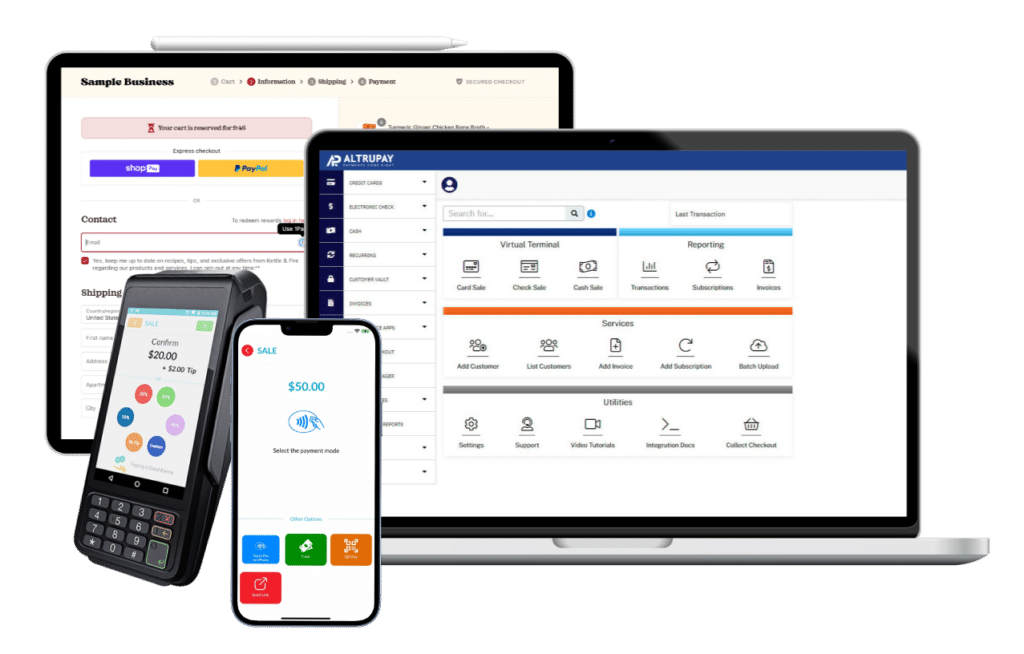

At AltruPay, we provide easy-to-use payments solutions for all types of businesses, regardless of industry or risk classification.

With several decades of combined payments industry experience, our team is passionate about helping business owners to simplify their sales and payments experience, and grow their businesses. We make payments simple!

- Credit Card Processing and Merchant Accounts

- Traditional “Brick and Mortar” Payment Solutions

- High Risk and Industry-Specific Solutions

- ACH and eCheck Services

- Partnership Solutions

Credit Card Processing and Merchant Accounts

AltruPay is a full-risk credit card processor, providing merchant services for a wide variety of industries, including both traditional businesses and retailers, as well as non-traditional and hard-to-place businesses. It is part of what makes us unique: serving all types of businesses with the trustworthy payments processing they deserve, regardless of their industry or risk classification.

Traditional “Brick and Mortar” Payment Solutions

The payments industry doesn’t always make things simple for business owners. At AltruPay, our goal is to change that, and dramatically simplify how your business takes payments.

Our merchant accounts and other payments services are easy-to-use, saving time in the initial setup, as well as in ongoing usage. Moreover, we offer customized pricing that is often dramatically lower than you’ll find offered by billion-dollar corporations.

High Risk and Industry-Specific Solutions

At AltruPay, we have developed deep expertise in several industries where businesses traditionally have had challenges with payment processing. Our expertise allows us to provide customized, industry-specific solutions so you can process payments securely and confidently, with a partner that understands the unique needs of your business.

Our industry expertise includes (but is not limited to) industries such as Alcohol, CBD, Firearms, Gaming, Live Goods, Nutraceutical, Pawn Shops, Sports Events, Self Storage, Travel, Vape, and many more.

Click here to view the complete list of our specialized industry-specific payments solutions.

ACH and eCheck Services

When it comes to accepting payments via ACH, the rules can be difficult to understand. ACH is essential for some businesses, and beneficial for many others. In many cases, the fees associated with accepting ACH or eChecks can be significantly lower than taking payment via credit card, creating a strong business proposition to incorporate this payment option into your business. ACH as a form of payment may also work better for your customers while also helping your business’ bottom line – a true win-win for all.

AltruPay offers a wide array of options to serve your ACH and eCheck processing needs. While all banks in the United States can use ACH, as a business owner, you want to be assured that your payment provider is up to the task – not only from a technical perspective, but from a customer service point of view as well. AltruPay is dedicated to providing the highest level of boutique service, and we strive to tailor payment processing solutions to best meet your needs. Let us work with you to find the best solution to fit your business and budget.

Partnership Solutions

Partner with AltruPay to grow your organization while providing a best-in-class solution to your merchants or customers. AltruPay can provide you with a partnership solution that is easy-to-use, and supports merchants in all industries and risk classifications.

Many types of organizations can benefit by partnering with AltruPay:

- ISO Agents: AltruPay can provide innovative payment solutions for any type of merchant, regardless of industry or risk classification.

- Industry Partners & Associations: We can create a customized program to fit the unique needs of your industry, and white-labeled with your brand.

- Point Of Sale Software: Our partnership program can seamlessly integrate into your software to grow revenue, while providing a great merchant experience.

Click here to visit our Partnerships webpage and learn more about how you can partner with AltruPay.